Charging pile industry basic situation

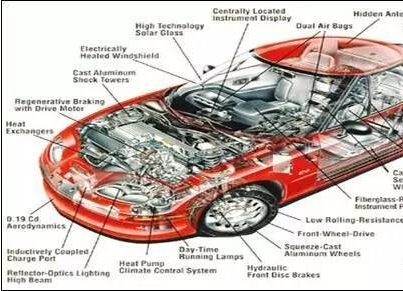

Charging piles are devices used to charge electric vehicles (EVs). They are traditional gas stations and alternatives. Charging pile mainly consists of piles, electrical modules, metering modules and other parts, generally has the functions of energy metering, billing, communication, and control. Charging pile equipment itself does not have too high technical content, competition differences are mainly reflected in the stability of the production equipment, compatibility, cost control, brand reputation and bidding ability. According to the different charging power, charging piles can be divided into two types: DC fast charging and AC slow charging.

Due to the high construction cost of DC charging piles, large construction area, and inflexibility in many aspects, the current market share of AC charging piles is still relatively high.

According to different types of service objectsAccording to different service targets, charging piles can be divided into three categories: private charging piles, dedicated charging piles, and public charging piles. Among them, the public charging piles are mainly provided by agencies with public services such as government agencies, and the service targets may be directed to the owners of any electric vehicles, such as charging piles in public parking lots.

Charging pile industry developmentWith the explosive growth in the number of new energy vehicles in the past two years, the scale of the construction of charging poles for supporting facilities has also expanded. According to the “Analysis Report on the Development Prospects and Investment Strategic Planning of Electric Vehicle Charging Pile Industry” published by the Industry Research Institute of Qianwang, the number of charging piles in China has increased from more than a thousand to 210,000 during the seven years from 2010 to 2017. In 2017, the construction scale of China's charging piles was 214,000. It is expected that the scale of charging piles in China will reach 500,000 in 2020.

China-Electric Vehicle Charging Pile Construction Scale, 2010-2020

April 2018 Electric Vehicle Charging Piles Ranked

As of April 2018, a total of 262,058 public charging piles were reported to the member companies in the alliance, including 114,472 AC charging piles, 81,492 DC charging piles, and 66,094 AC/DC integrated charging piles. In April 2018, 8984 public charging stations were added in March 2018. From May 2017 to April 2018, monthly average new public charging piles were 8405, and in April 2018, the year-on-year increase was 62.5%.

The number of public charging infrastructure data in provinces, districts, and cities (excluding Hong Kong, Macao, and Taiwan) and the number of public-type charging piles in provincial-level administrative areas are respectively: 40184 in Beijing, 33666 in Shanghai, and 32,693 in Shanghai. There were 27,152 in Jiangsu, 20,282 in Shandong, 12,734 in Zhejiang, 11,422 in Tianjin, 11,087 in Hebei, 10782 in Anhui, and 7,340 in Hubei.

April 2018 Electric Vehicle Charging Pole Number Provinces and Cities Rank TOP10

By the end of 2016, there were 150,000 public charging stations and 80,000 private charging stations. According to the 2016 plan, it is planned to build 100,000 scattered public charging piles and 860,000 private dedicated charging piles. In 2016, the growth rate of public charging pile construction reached 200%, but the construction speed of special-purpose piles was obviously not up to expectations. To speed up the charging infrastructure, the residential community and the unit's parking lot charging piles are the key development directions and optimize the layout of public charging piles. In 2017, we will strive to increase the number of new charging piles to 800,000, including 700,000 dedicated piles and 100,000 public piles. According to this plan, the dedicated piles in 2017 will have a growth rate of nearly 9 times.

Dedicated charging stakes increase in the next four years

Four major operators

At present, there are more than 100 operators in the charging pile market, but the top four operators of State Grid, Putian, Vanguard, and Special Calls account for 86% of the market.

National and local governments strongly support the construction of charging facilities

As the configuration of the charging pile is the most important factor for most users when purchasing a new energy vehicle, the perfection of the charging facility is crucial for reducing the user's mileage anxiety. Therefore, the clear specification of the charging pile industry has become a key link in the development process of China's new energy vehicles with importance and necessity. Since the second half of 2015, national and local authorities have successively issued policies concerning charging piles to better promote the development of new energy vehicles.

At present, the State Grid is still the largest investment entity in the field of domestic charging piles

Charging operation As an electric power industry involved in the control of the country, service fees and electricity prices have been guided by the state. As the provider of electric power and the main regulator of charging standards, the national grid has a significant advantage. The development of the “e-charging network” operating platform under the State Grid is also growing. Therefore, the status of the State Grid in the field of charging station operations cannot be shaken in the short term.

However, in the future, after the development of the industry is gradually standardized and matured, the social investment subject will become the main force for investment in charging facilities, and the market share of the State Grid will gradually decrease. In the short term, the profit rate of the charging stake won by the State Grid will still maintain a high level.

Charging pile needs to be further improved

Driven by new technologies such as Big Data, Internet of Things, artificial intelligence, and virtual assistants, the intellectualization of charging piles is getting higher and higher. Currently, users who use the mobile phone to charge the device position occupy the majority of charging users. Charging customers can also use the mobile client to perform system access and charge payments. The charging pile owner can remotely monitor the charging equipment through the mobile phone to ensure the normal operation of the charging service. In addition, after the pile is paired with the mobile phone, the pile owner can remotely charge the peak by charging the mobile phone to save the charging cost. These mobile phone applications have fully tapped the function of the charging pile, and greatly improved the use efficiency of the charging pile.

Private charging piles occupy half of the country and this area cannot be ignoredLooking at the domestic charging pile market, private charging piles can be described as occupying half of the country: By the end of 2017, the number of charging piles in China had reached 450,000. Among them, there are 210,000 public charging poles and 240,000 private charging poles. The private charging pile is a charging pile that the user invests and constructs in the community to meet the needs of his own vehicle. The private charging pile market has a lot to offer.

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite

![[Charge pile principle] electric vehicle charging pile principle Secret](/upload/image/20170504/20170504090205_67304.jpg)