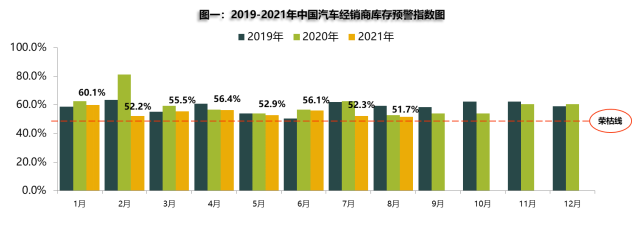

According to the latest issue of the "Vehicle Inventory Alert Index Survey of China's Auto Dealers Inventory Alert" issued by the China Automobile Dealers Association, the inventory alert index of auto dealers in August 2021 was 51.7%, a year-on-year decrease of 1.1 percentage points and a month-on-month decrease. 0.6 percentage point, the inventory warning index is close to the line of prosperity and decline, and it is still in the recession range.

2019-2021 China's auto dealer inventory warning index chart

August is in the transitional phase of the off-peak season. Benefiting from the favorable factors such as the school season and holidays approaching, some market demand has been released. However, due to factors such as high-temperature holidays, heavy rains and epidemics of manufacturers, consumers were affected by the shortage of chips in stores, and the impact of superimposed chip shortages became more apparent. In August, the market broke the market law of previous years and did not perform as well as July. Unfavorable factors such as the Malaysian epidemic, the tight automotive semiconductor supply chain, and the shortage of chips have led to an imbalance between supply and demand, and the contradiction of structural shortages in the auto market has further emerged.

"Mid-to-late August is also a stage where major domestic dealer groups intensively release semi-annual reports. By analyzing the interim reports of each dealer stage, we can see the average selling prices of luxury, ultra-luxury, and mid-to-high-end brands under almost all listed dealer groups. The year-on-year increase, and this is still the situation in the first half of this year. The problem of insufficient vehicle supply in July and August will be more serious, so the increase in transaction prices in July and August will further intensify." Qiu Kai said.

Under the above-mentioned background, many dealers adjusted their marketing strategies and adopted insured sales to stabilize the market and prepare for the peak sales season of "Golden Nine Silver Ten". Consumers are less motivated to buy, car sales are declining, and dealer profits are declining.

From the perspective of sub-indices: the market demand and average daily sales index rebounded in August, while the inventory, employees, and operating conditions index declined. Judging from the regional index situation: in August the national total index was 51.7%, the northern district index was 58.2%, the eastern district index was 49.7%, the western district index was 53.6%, and the southern district index was 47.4%. Affected by heavy rains and the epidemic, sales in some provinces have declined significantly, and inventories have increased. From the perspective of the sub-brand index: the import & luxury brand index, the mainstream joint venture brand index, and the independent brand index declined month-on-month in August. The shortage of chips has a greater impact on the supply of luxury and joint venture brands, and the inventory warning index for imported & luxury brands has fallen below the line of prosperity and decline.

Qiu Kai further analyzed, "The overall auto market in August showed structural contradictions. Specifically, there was a mismatch between the vehicle supply of dealers and consumer demand for vehicles. On the one hand, dealers had no vehicles to sell, or the cycle of delivery. Longer time; on the other hand, consumers have to wait for a long time, or the current terminal preferential prices are not as big as before, so they hold a wait-and-see attitude. Coupled with the epidemic and seasonal factors in August, the overall sales in August are expected to be 1.5 million The number of vehicles is about 10% lower than that in July."

Talking about whether the auto market will pick up in September, Qiu Kai said frankly that “whether the market will pick up in September compared to August will largely depend on whether the OEM can find an effective solution to the problem of chip shortages.”

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite