Interpretation of 2 GW-class PV markets in Brazil and Chile

The vast regions of Latin America and the Caribbean are mostly developing countries. The region is rich in light resources and is very suitable for photovoltaic development. It currently has two GW-level markets in Chile and Brazil. The two major markets have their own distinct advantages, and we do a simple analysis here. 1. Chile: the best light resources, a good policy environment and a huge distributed market with great potential

1.1 Introduction to the Chilean PV Market:

As a hot spot for renewable energy investment, Chile has achieved great advantages with low labor prices, abundant light resources (the best irradiance in the world) and a good financing environment. In Chile's national electricity auction, clean energy can use price advantage to defeat fossil fuels. Therefore, the Chilean government has proposed a coal decommissioning plan. It is expected that by 2030, solar energy will become Chile's main source of electricity, covering more than 30% of domestic electricity demand. .

Chile's current PV policies mainly include tendering, net billing, tax breaks, and public solar roof plans. The net billing policy applies to small projects below 100 kW. The Ministry of Finance encourages the development of renewable energy through subsidies, while the public solar roof plan is promoted by the Chilean Ministry of Energy to save energy costs for public buildings. The plan will give priority to areas with higher emissivity and higher electricity prices.

1.2 Advantages of Chilean Solar Development

• 97% of Chinese products are exported to Chile without customs duties. Chile is a very open country and the first Latin American country to sign a free trade agreement with China. The state's policy of encouraging photovoltaic development has also greatly driven the development of Chile's photovoltaics.

• Chile relies heavily on fossil fuels, mainly coal-fired power, which accounts for less than 11% of solar energy, and in 2013 Chile's electricity price was $150 per megawatt, one of the highest electricity prices in South America. The electricity price in Chile is very expensive, and the potential of solar energy has not been realized, and it is impossible to supply electricity to the south central. In 2017, 57% of Chile's electricity generation was thermal or coal-fired, and 43% was renewable.

• The region with the highest intensity of sunshine in northern Chile is home to many mining companies. Chile is the world's largest exporter of copper and the region has the largest number of potential PV customers.

1.3 Chile ground large centralized power station project

The Chilean PV market is dominated by large-scale projects, with more than 50MW of tenders. According to the data released by the official CNE of Chile, the total number of projects currently in use on the grid is about 2,341 MW, and the project under construction is 289 MW. Although Chile still has nearly 2GW of reserves, Chile's renewable energy generation is greatly limited due to the saturation of transmission systems. It is expected that the large-scale project market will further shrink in the next two years.

1.4 Chile Distributed Market

As of the end of December 2017, Chile's distributed solar grid-connected capacity is only 13MW, mainly driven by the national distributed solar roof plan. Given the huge development potential of Chile, it is expected that this segment will grow substantially in the future.

In 2019, Chile will have 55 new PV power plants in operation. The Chilean National Electricity Coordination Bureau predicts that coal power generation will still dominate next year, accounting for 40.4% of total power generation. Hydropower generation followed, accounting for 30.2%. The solar power generation amount is 7345GWh, accounting for 9.4%, making it the third largest power source.

2. Brazil: South America's top economies include electricity and seawater desalination

2.1 Introduction to the Brazilian PV Market

In Latin America, Brazil is the second country with more than 1 GW of PV installed capacity after Chile. According to the latest data of the Brazilian Solar Energy Association, the cumulative installed capacity of photovoltaics in Brazil reached 1099.6 MW in 2017, of which 935.3 MW is a large-scale ground photovoltaic power station and 164.3 MW is a distributed photovoltaic (less than 5 MW). It is worth noting that at the end of 2016, Brazil's large-scale ground PV power plants installed only 24 megawatts, and in 2017, about 910 megawatts were put into operation in 2017.

China and Pakistan have been friendly for generations. Since the establishment of diplomatic relations in 1974, they have reached a comprehensive strategic partnership in 2012. The two governments will deepen energy cooperation and formulate the "six major areas" based on energy. CMB also belongs to the BRICS countries.

In July 2015, the Brazilian government introduced a photovoltaic industry incentive policy to alleviate the shortage of power supply. The Brazilian National Electricity Authority and the Fiscal and Taxation Policy Committee are exempt from the tax on goods and services in the power supply sector. In December 2015, the Brazilian government adopted the “Decade of Energy Plan” (PDE), which set a target of 8.7 GW of PV installed capacity. The Brazilian National Development Bank supports the development of renewable energy projects and expands cooperation with international financial institutions on a global scale. This business has a large scale of financing and involves a wide range of foreign investment.

2.2 Several key messages

2.2.1 The close relationship between renewable energy development and the Brazilian economy

Foreign scholars have summarized four types of energy consumption in Brazil: non-hydrogen renewable energy consumption (NHREC), total renewable energy consumption (TREC), non-renewable energy consumption (NREC) and total primary energy consumption (TEC). The relationship between Brazil's real GDP and four types of energy consumption is: NHREC/TREC has a positive and significant impact on GDP. The impact of NREC/TEC on GDP is irrelevant. The error correction model explains the one-way causal relationship from NHREC consumption to rapid economic growth [Hsiao-Tien Pao&Hsin-Chia Fu 2013]. The above research shows that Brazil is an energy-independent economy. Renewable energy plays a leading role in economic growth. Expanding renewable energy not only drives Brazil's economic growth and suppresses environmental degradation, but also is an important means for Brazil to improve its national competitiveness.

Domestic scholars have concluded that renewable energy development in Brazil is diverse, and biomass energy (ethanol), hydropower, wind power, and photovoltaics are all important components of renewable energy in Brazil. Brazil is known for its renewable energy matrix (41% of total energy production comes from renewable sources), Brazil's economic growth and renewable energy growth mutually promote, and energy demand will increase further, renewable energy to the end of this century In the end, it will be dominated by solar energy, which will account for more than 60% in Brazil [Ying Qichen 2016].

2.2.2 Analysis of Opportunity Points in Brazil

The above table shows the basic situation of Brazil by region. The highlight is the region with the highest population density in the northeast. It not only has the best light resources in Brazil, but also has a relatively developed economy and a large demand for electricity. Significant environmental advantages, no hurricanes, earthquakes, marine erosion, the above advantages will significantly reduce system costs, commercialization and project financing success rate will be greatly improved.

The southeastern region is the most developed region in Brazil. The famous cities such as Rio de Janeiro, São Paulo and Minas Gerais are in this region. This region accounts for 55.4% of Brazil's total GDP and 51.8% of total electricity consumption. . The potential market for industrial plant roofs is large. In addition, the past few years have been affected by severe droughts, so there will be a large market for new PV + seawater desalination models in the main power areas of the East Coast.

2.2.3 Market risk

Deindustrialization, ignoring the stagnation of the country's modernization caused by the real economy, is at the bottom of the global industrial chain.

High taxes, inefficiencies caused by government corruption and potential political risks.

Solar energy accounts for a very small proportion, and Brazil is highly dependent on hydropower and biomass to generate electricity.

Related articles

-

What are the new games in the PV industry?

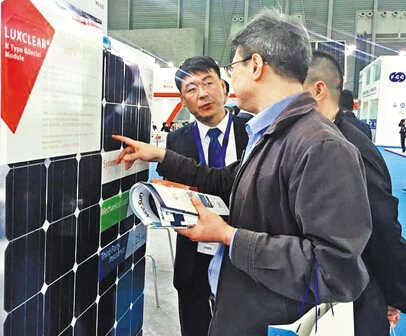

At 2017 Shanghai Photovoltaic Show, exhibitors are introducing the latest PV panel products to buyers.As the world's largest photovoltaic power, China's photovoltaic industry in the future will expand

-

India's PV industry 75% of Chinese products using 15% from the United States imports

At present, although India to replace China as Asia and the world's fastest-growing economy, the main economy, but its power supply shortage is extremely serious. In order to solve this problem, India

-

PV industry will welcome the most complex situation in five years

So in 2018 we came in a hurry. With the PV installed capacity in 2017 and the record high subsidy gap, with the continuous expansion of production scale and the continuous decrease of profits, with th

-

The way for PV industry is to improve economy

Whether the PV market can maintain its rapid growth in 2018 will attract much attention. Yi Yuechun, vice president of China Water Conservancy and Hydropower Planning and Design Institute, said that i

-

PV industry competition will be more severe Marketization trading is the best opportunity

On March 13th, quality innovation and innovation led the seminar on photovoltaic advanced technology. Wang Sicheng, a researcher at the Energy Research Institute of the National Development and Reform

-

Rooftop photovoltaic is leading the PV industry

In the past two years, the growth rate of photovoltaic power generation is the fastest in clean energy, among which the development speed of rooftop photovoltaics is extremely significant. The data sh

-

In the first quarter, the PV industry as a whole achieved a “double ups and downs”

“In the first quarter, China’s energy operation started well and the low-carbon transformation of energy structure continued.” At the press conference held by the National Energy Administration on the

-

Analysis of China's PV Industry Development Trends

Photovoltaic industry as a new energy industry with significant development value, the characteristics of its clean, efficient and sustainable use make countries have successively invested in the deve

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite